Traditionally, companies need to go through several rounds of financing during their lifetime. More often than not SMEs find themselves left out or pushed against a wall – nobody gives money to companies before they’re starting to scale and everybody wants an equity piece if your company already scales.

So companies start out with seed financing from angel investors that promise funding and great network effects and just take a piece of your equity in return. Once you have then proven as a company that you can deliver on your products and promises, the world of venture capital talks you into more rounds of financing taking away more and more equity from you.

Once your friends, families and seed investors are invested in your company, you probably still require additional financial resources to finance your growth. An IPO (Initial Public Offering) is only a viable option if you already have strong growth numbers and robust operations and governance systems in place. It will still cost you approximately 1,2 million Euro in structuring and listing fees and your company will have to put down an additional 600-800k Euro per year to file all required documents in a compliant manner. Every year.

Blockchain changes that.

When issuing a security token, a company ensures legal compliance with the regulatory body and can, therefore, market the instrument easily. Investors are more likely to invest as the company takes on the legal and financial obligations of traditional securities.

By conducting a Security Token Offering (STO), you can achieve the same capital influx at a fraction of the costs in the exact same compliant manner. Moreover, terms are usually more favourable and you don’t have to pay the middlemen. Introducing STOs.

STO stands for Security Token Offering.

When you conduct an STO it means your company issues a regulatory-compliant financial instrument, such as equity shares, a debt note or a mezzanine instrument, such as a revenue participation note.

The great advantage in comparison to securing investment the traditional way is manyfold:

- You address a new and digital native target group potentially willing to invest in cryptocurrencies

- You save 90% of the costs due to the elimination of middle-men, e.g. clearing & settlement services are rendered obsolete in an STO

- Your financial instrument is seamlessly tradable on secondary markets, hence liquidity and value appreciation are higher

- The blockchain technology enables you to file all required compliance documents automatically without lawyers, assurance and other staff

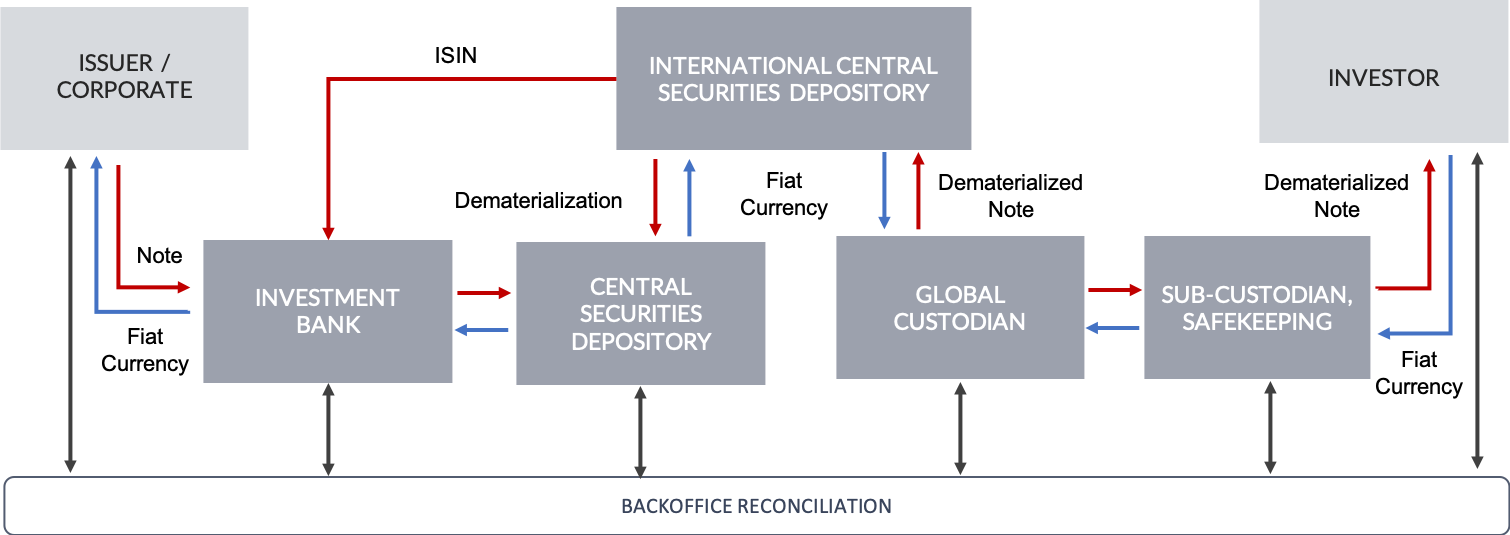

This is what it looked like to issue a security/do an investment round without blockchain:

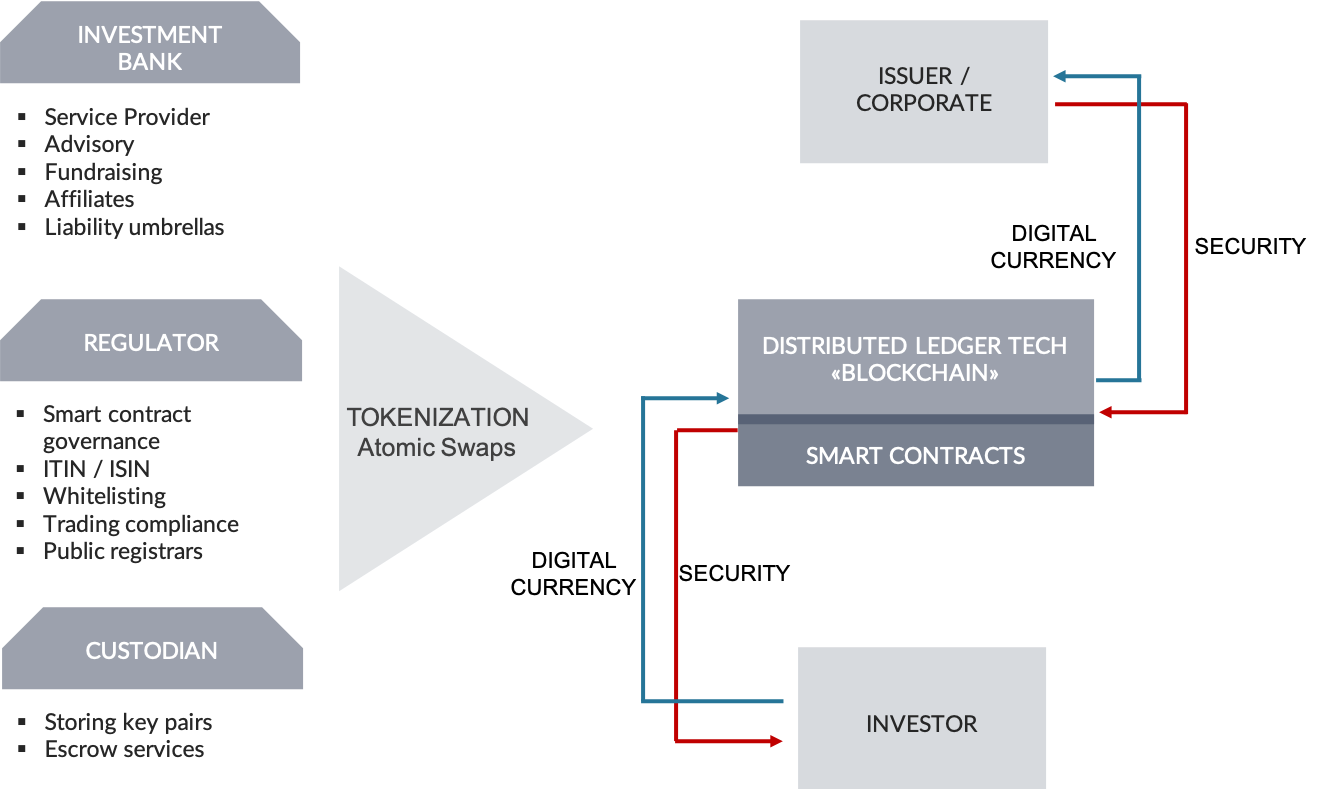

Here is the process flow with a security token offering:

Do you want to know more? You can find additional information on one of the latest STOs in Germany here.