Project Description

What’s a RPN?

A Revenue Participation Note (RPN) is a very flexible hybrid of equity and a debt instrument and is classified as a security across regulatory regimes, hence requires approval from the regulatory bodies of the governing jurisdiction.

CLIENT PROFILE

Our client is a leading producer of biosurfactants with more than 20 experts in the fields of microbiology, biochemistry and bioengineering. For its groundbreaking research on the industrial application of eco-friendly bioagents, they won several awards.

| Industry | BioTech |

| Employees | 11-50 |

| Year founded | 2012 |

| Publicly listed | No |

CHALLENGE

Enable our client’s series-B funding through a DLT-based financial instrument, that qualifies to both provide revenue participation to investors, whilst limiting the company’s down-side and not dilute shares.

PROCESS

The project was structured into four distinct steps:

1. WORKSHOPAfter several top-management workshops and meetings with investors from the seed-round, we narrowed down several financial instruments for our client that fulfilled all of the specified requirements. During the workshop we specifically covered the following aspects:

|

|---|

2. FEASIBILITYThe client received a feasibility study to ensure that all regulatory and technical requirements were met. Before starting with the implementation we specified the following in the feasibility study:

|

|---|

3. REG & LEGALAll applicable security acts within the EU were analyzed and applied to the intended investment scheme including, but not limited to:

|

|---|

4. TOKEN GENERATION EVENTThe implementation of the STO was preceded by the regulations compliance process and official approval of the Federal Financial Supervisory Authority in Germany (BaFin):

|

|---|

SOLUTION

We structured a Revenue Participation Note (RPN) based on the ERC-20 standard and designed the issuance process as a Dutch auction, where the maximum revenue participation for investors increased over time.

RESULTS

We designed a regulatory compliant RPN that could be passported across the entire European Economic Area with one WpPG-prospectus that was filed with the German Financial Supervisory Authority.

DETAILS

Click on the toggles to find out more about the specific project details:

Our client's company was founded in 2011 and is a biotech start-up that specializes in the production of biosurfactants and is one of the leading manufacturers of those. In order to fund the rapid expansion and produce their product at an industrial scale our client required 30.000.000 EUR.

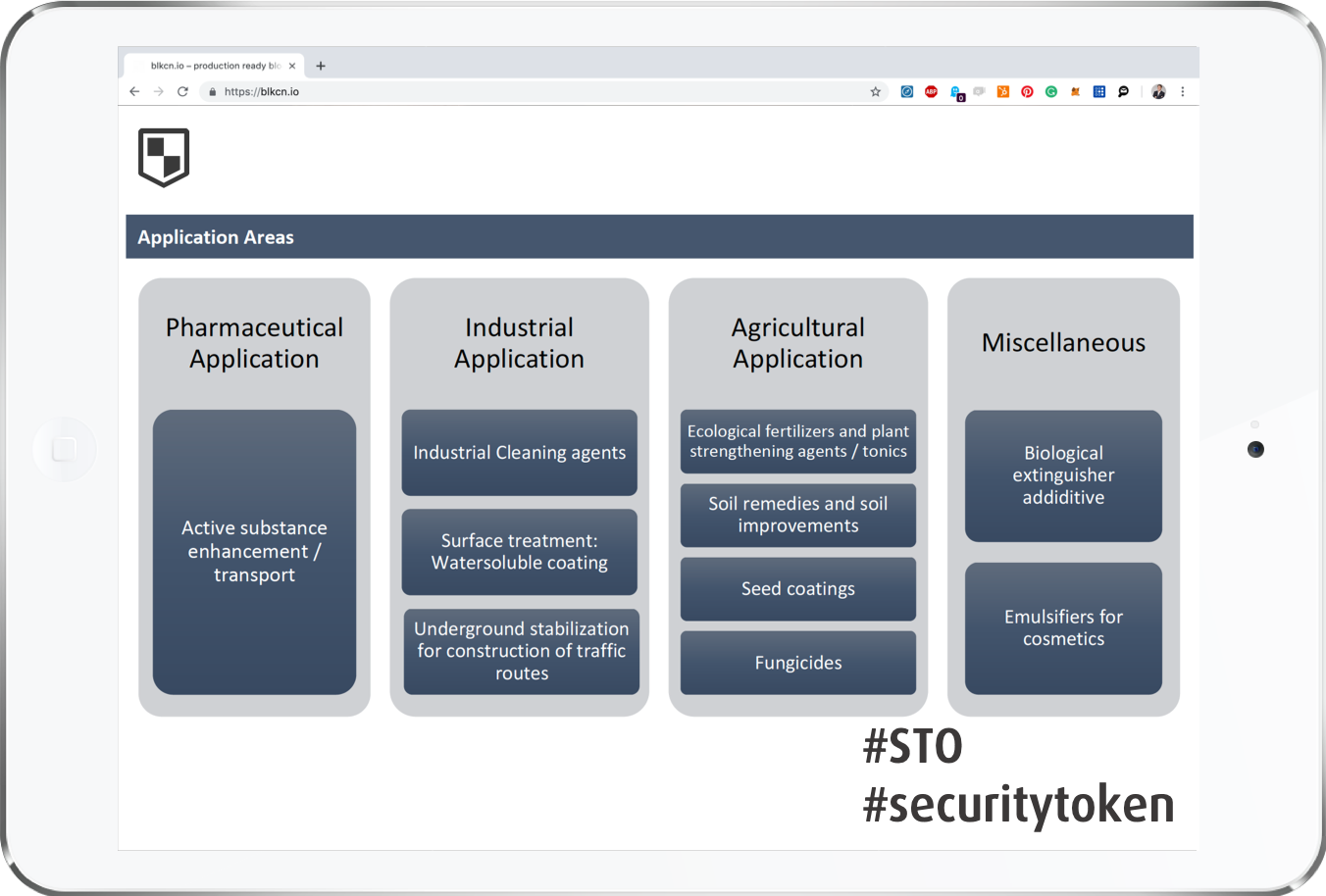

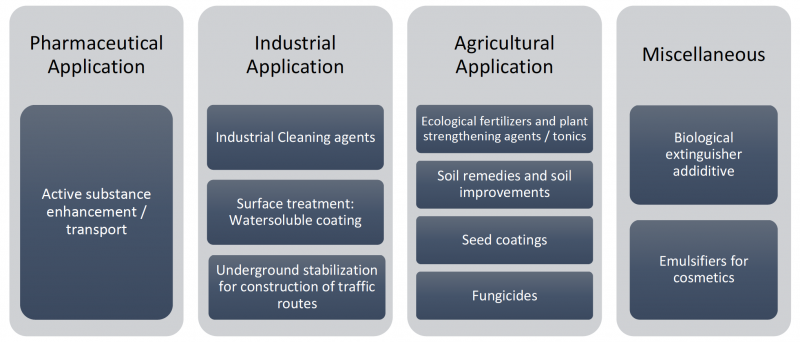

The product has a wide range of applications:

- Washing and cleaning agents

- Pharmaceuticals

- Soil contamination

- Feed/Fodder additives in animal breeding

- Mushroom comb

- Cosmetics etc.

Market for Biosurfactants grows annually by approx. 4%; Rhamnolipids are the most lucrative segment according to market research.

The company is a subsidiary of a Swiss AG. There are cooperations with numerous universities. 20 experts cover the following areas within the company:

- Microbiology & Biochemistry & Biotechnology

- General Management

- Accounting & Controlling

- Sales & Marketing

After several top-management workshops and meetings with investors from the seed-round, we narrowed down a financial instrument for our client that fulfilled all of the specified requirements.

First, the company’s shares and it's cap table needed to remain intact. The client did not want any dilution. A typical private equity placement, however, is expensive and time-consuming. It can also lead to a loss of control. Public offering is even more expensive and complicated, while the circulation of the company’s shares on an open market can entail many difficult-to-predict consequences. A RPN allows shares to stay intact and minimize the risk of a debt-trap, if there the company experiences an economic downturn.

Since payouts only occur when the company has revenue, the company endures only feasible debt obligations. As a bonus, the company did not have to provide collateral. From the fundraiser’s perspective, a debt with fixed payments complicated business planning. In the case of the RPN, the company simply got less turnover, as if fewer customers were coming to them per unit of time. In the case of an ordinary debt instrument, the company would have been obligated to pay on time, even when experiencing economic turmoil.

From the investor’s point of view, traditional debt is not the most desirable instrument, since there is no upside. An RPN, however, can be paid faster than expected. In our client's case, we generated an RPN formula with various bonuses according to the point in time the investor came on board.

Second, investors had a direct incentive to promote our client's project, as the increased turnover immediately affects their payouts.

Third, fundraising was conducted in a safe regulatory regime once the prospectus requirements were specified and implemented.

Tensides are substances that allow the solution of fat in water. Rhamnolipids are organic surfactants:

- 100% organic

- non-toxic

- do not cause allergic reactions

- good foam properties

- active substance carrier/excipient

- substance booster

Surfactants have a wide range of uses. The market for biosurfactants is growing and the company is the market leader in the area thanks to the industrial production of biosurfactants. The market for surfactants is 14.8 million tonnes (as of 2015) and 33 billion USD. The market is expected to grow 2.5% per year to a total addressable market of 40.4 billion USD in 2022. The market for biosurfactants is 5% of the total market: $1.7 billion USD with market growth of 4% annually.

These are the most important application areas:

In this case, we had to undergo several additional steps with several regulators that are not required with Initial Coin Offerings (ICO) of utility token as the token was issued according to the WpPG in Germany and passported across the European economic union (EWR).

The entire company setup of our client, including its headquarters in Switzerland and operating entities in Germany were taken into account when conducting the legal feasibility. The following items, codes and regulations were researched and testified by our in-house counsel and external law firm partners:

- Differentiation and taking stock of requirements to classify financial instruments as securities according to the European and specifically German Security Prospectus Act (WpPG) and private placement according to Asset Investment Act (VermAlG)

- Issuance of financial instruments in Switzerland, specifically obligation rights (e.g. Art. 165 Sec 1 OR) with no equal classification in Germany, specifically § 2 Sec . (1) No. 1 KAGB

- Safeguards for licensing agreements and patent protection under various legal regimes

- ESMA-conformity and passporting checks, specifically required historical financial information according to § 7 WPpG and EG No. 1606/2002

- The legal classification of the token as a financial instrument, but not a currency according to § 2 Sec. 1 WpHG and Art. 4 Sec. 1 No. 44 MiFID II

- Evaluation of finance commissioning regulations according to German Governance Banking Act, specifically § 1 Sec. 1 phrase 2 N0. 4 KWG

- Structuring of the required prospectus and its contents according to the European Commission Act EG N0. 809/2004 with reference to its implementation in 2003/71/EG

To fund the rapid expansion of its production capacity for Rhamnolipids in its sites our client asked us to organize a Security Token Sale. The security token being issued is compliant with and a «security» as per the German Securities Prospectus Act (WpPG). As we created the token to be tradable on the secondary market, the token represents an order instrument, as ownership of such papers can be transferred per order. This gives a chain of reference to the original underwriter. This is represented by the token. The bearer instruments indicate the right to purchase solely through ownership. The offer contract of the tradable participation is designed in such a way that only the token proves the right to purchase.

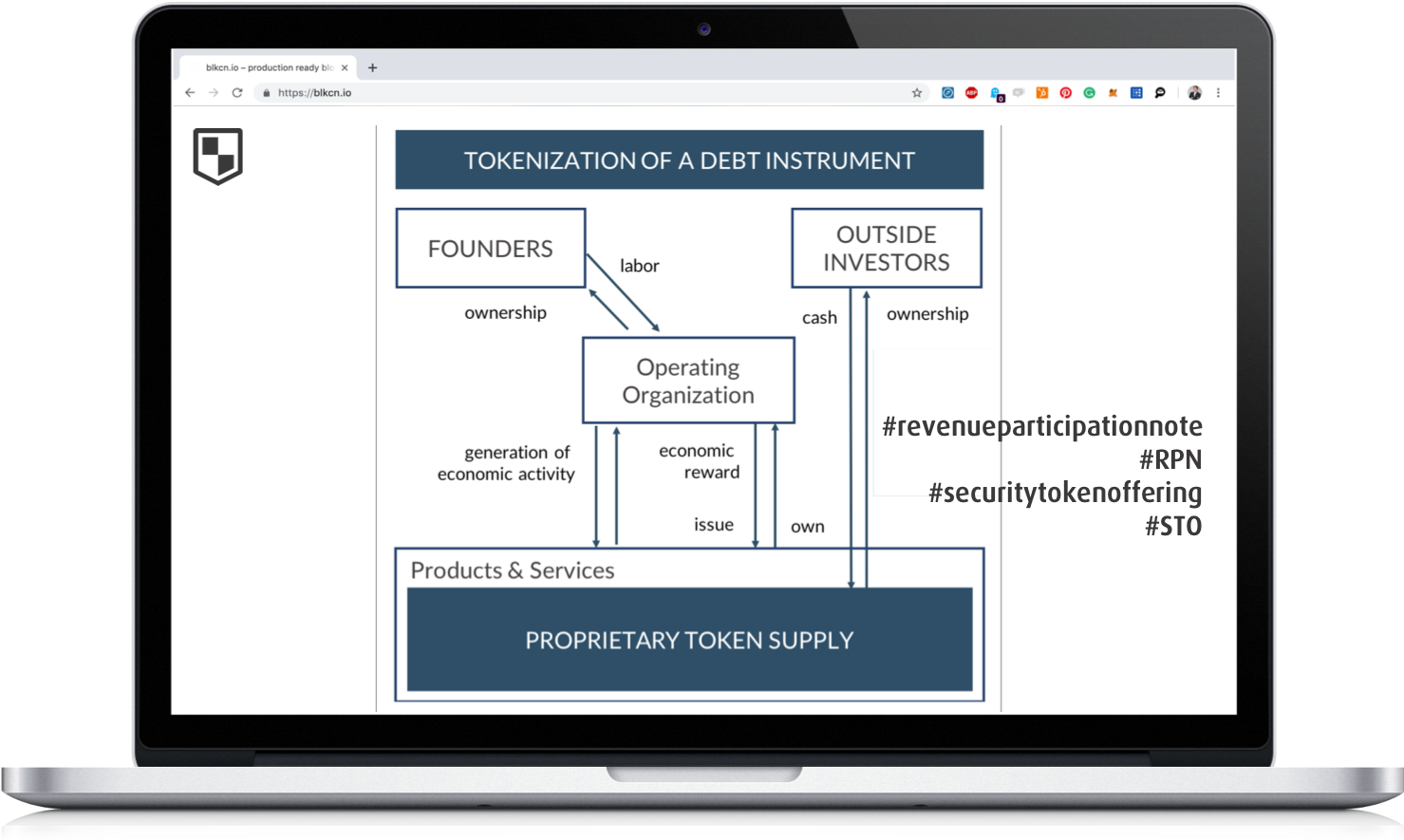

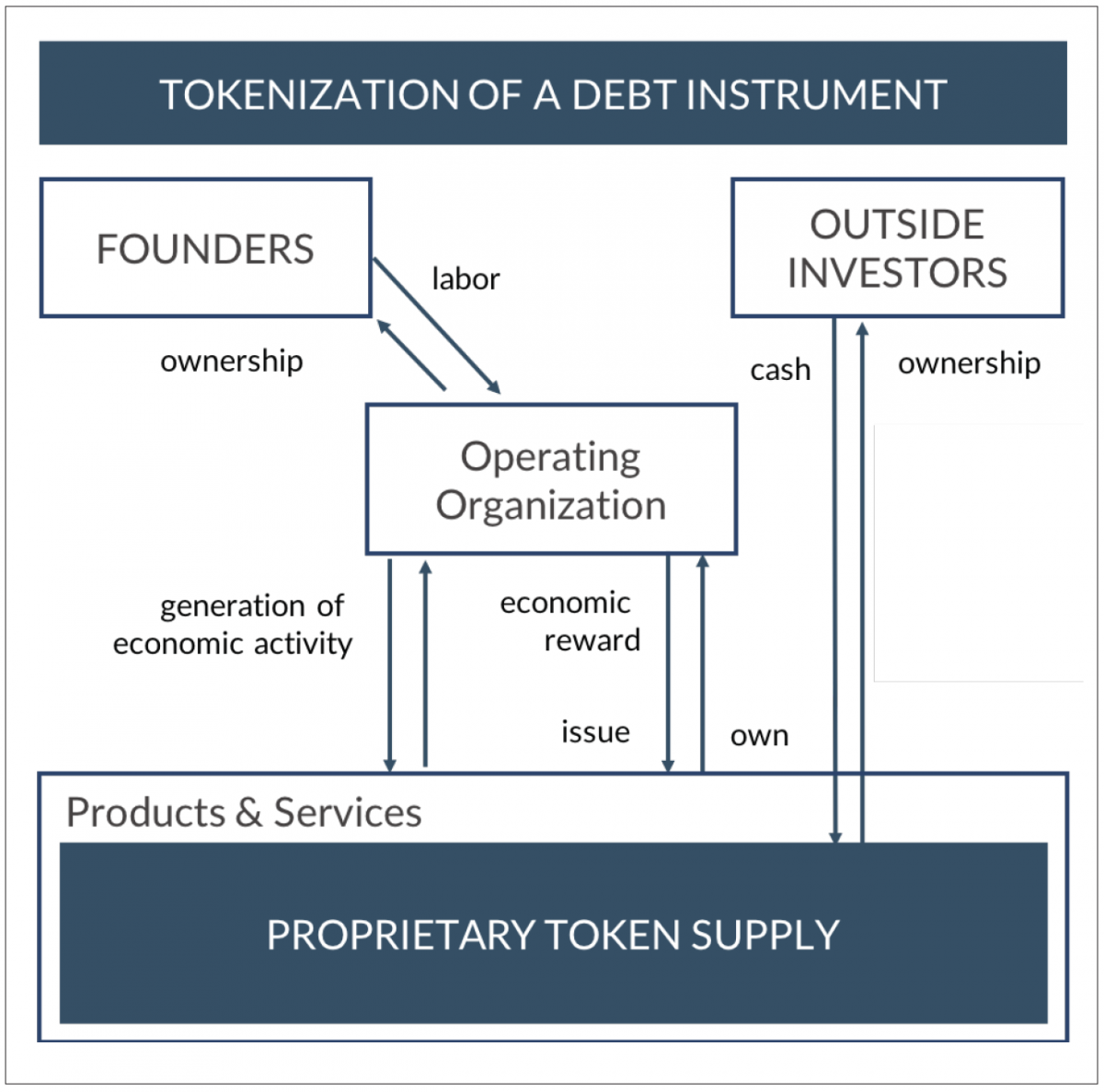

The general architecture depicted below applies:

For deposited funds investors receive token. The maximum number of issued tokens was determined by the financing target limited to 3,000,000 tokens. The nominal price for a token is set at 10,00 EUR.

The token is classified as a security both according to civil law and supervisory law. This also means that in case of loss of the private key, there is an opportunity for a claims notification procedure. In other words, the private key can be replaced by the issuer, similar to a savings bank replacing a lost savings book. The token represents the investor's claim against the issuer and serves as a right to benefit from the annual yield payments.