Project Description

What is credit netting?

Credit netting is the process of netting out accounts payables and accounts receivables with a specific creditor or debtor. In this case, we created a platform and allowed our client to enable netting between its clients as well as other partnering financial institutions.

CLIENT PROFILE

Our client is a fast-growing non-captive automotive bank with several thousand clients, both dealerships and consumers, and various innovative product solutions.

| Industry | Financial Services |

| Employees | 201-500 |

| Year founded | 2011 |

| Publicly listed | No |

CHALLENGE

The client intended to net out credit with its clients and other banks without having to change its core systems and associated process landscapes or write new interfaces for each new partner.

PROCESS

A company can reduce its contract exposure significantly by netting out the accounts payables and receivables in its entirety. Hence, the company’s risk-adjusted return is increased when implementing a netting solution. This case was part of a larger DLT project we implemented.

The design of the R3 Corda solution will be implemented in three steps:

1. WORKSHOPThe workshop covered several aspects before we moved from discovery to the design phase:

|

|---|

2. FEASIBILITYDuring the scoping phase of the case, we reviewed the general applicability of credit netting within the existing organisation, its benefit to overall contract exposure and the role DLT played in automating such a process. The feasibility report covered the following aspects of credit netting:

|

|---|

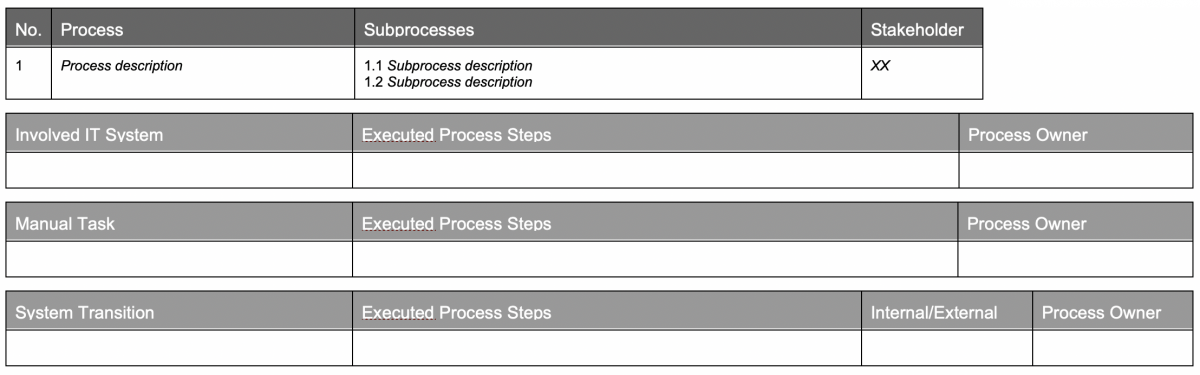

3. POCThe implementation of the PoC is preceded by several system workshops and process audits. Once all processes, system transitions, and manual tasks involved were documented we proceeded to define the target model:

|

|---|

SOLUTION

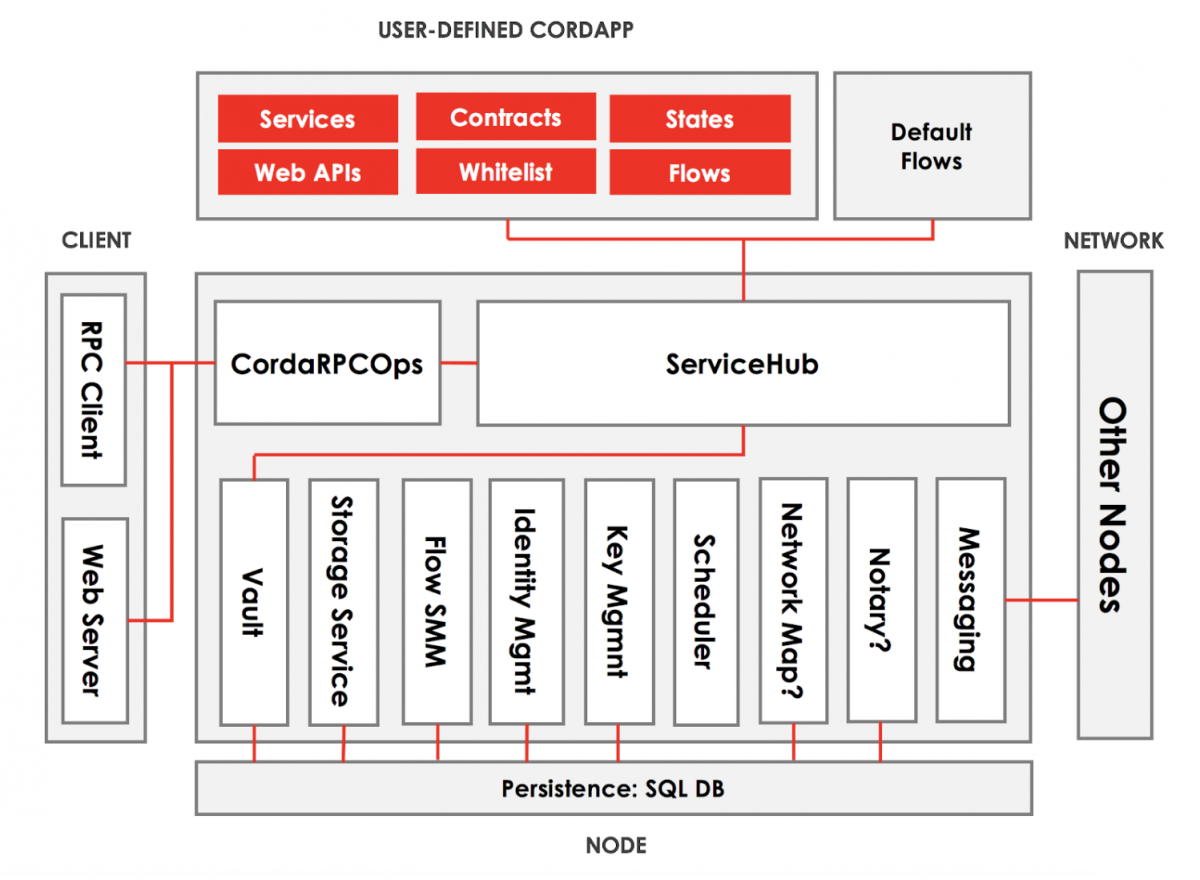

We used the R3 Corda framework to design a system architecture that enables the bank to net out credit from both procurement and sales financing loans with its dealerships and partnering financial institutions.

RESULTS

With Corda a shared ledger can exist between two interfacing nodes only. The legal prose feature enables the client to assign transactions legal context and allow the application to reference underlying agreement parameter and terms.

DETAILS

Click on the toggles to find out more about the specific project details:

Since the client processed several thousand transactions each month involving a high percentage of counter-payments with b2b and b2c customers. Both accounts payable and accounts receivable were settled separately, hence involving significant contract risks.

The target was to enable the client to net out accounts payable and accounts receivable, which the core system did not allow up. As a DLT layer can interface with the existing core, we quickly narrowed down several options of how to enable «Netting» without changing the existing system landscape.

The deliverables that needs to be provided were narrowed down to:

- Analysis of existing process landscape

- Analysis of actors within the landscape, manual tasks involved, and transitions between systems including reconciliation efforts where applicable

- Design of a target model to facilitate Netting involving a secondary IT layer without changing existing systems

- Detailed description of system interfaces

- Selection of a DLT framework

- Design of an initial configuration allowing a high degree of process automation

Once all processes were documented, our enterprise architect started analysing specific requirements.

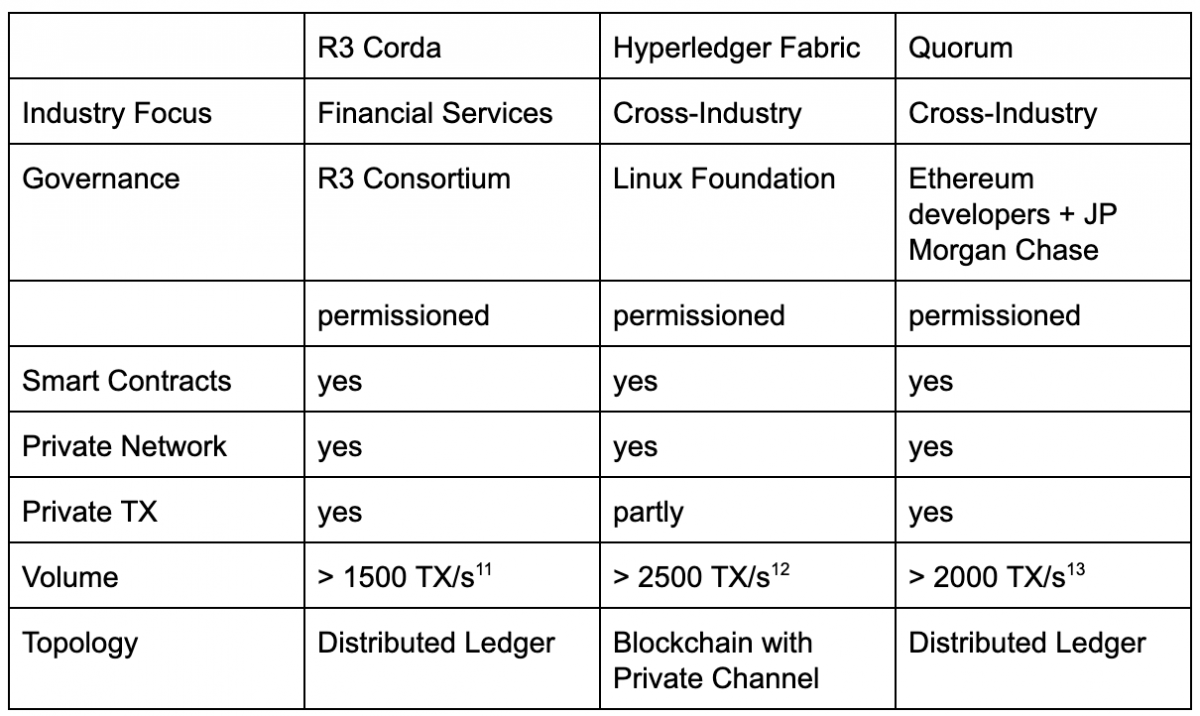

Since the client operates a bank and deals with confidential information that cannot be seen by uninvolved parties, no blockchain with a global state is applicable.

We narrowed down several private, permissioned DLTs and evaluated each framework through our selection heuristic.

After several iterations, we narrowed down the search to three DLT frameworks:

The project was eventually implemented in Corda.

In order to design a consistent target model & system architecture, this is what the project team on our side looked like:

- Enterprise Architect «client»

- Lead Developer Backend «client»

- Lead Developer Frontend «client»

- Senior Consultant Digital Business «client»

- Enterprise Architect «howtogetthemoney.com»

- Lead Developer Corda «howtogetthemoney.com»

- Development Operations Manager «howtogetthemoney.com»

- Project Management Office «howtogetthemoney.com»

We defined all required components of the CordApp, before starting to model the consolidated processes and starting to code the application.

Once all components were defined, we developed the integrated target model for the subprocesses of credit application and credit netting.

Time to delivery for the overall project, which included additional cases, is set to 14 weeks.