Project Description

CLIENT PROFILE

Our client is an accounting service provider that operates an integrated platform offering accounting, tax, consulting, legal, collection and customs handling to SMEs and corporate clients.

| Industry | Accounting |

| Employees | 10-50 |

| Year founded | 2011 |

| Publicly listed | No |

CHALLENGE

The were asked to automate Purchase-to-Pay (P2P) and Order-to-Cash (O2C) transactions and for the company’s clients and enable simply audits through a blockchain-based triple-accounting solution.

PROCESS

The project was structured into three distinct steps:

1. DISCOVERYDuring the discovery we covered several aspects:

|

|---|

2. WORKSHOPDuring the workshop narrowed down all relevant topics to move to the design phase:

|

|---|

3. WHITEPAPERWe conducted a detailed feasibility report taking into account all relevant software requirement specifications:

|

|---|

SOLUTION

We designed a permissioned blockchain to ensure transactional traceability, transactional immutability and document & information privacy throughout the system.

RESULTS

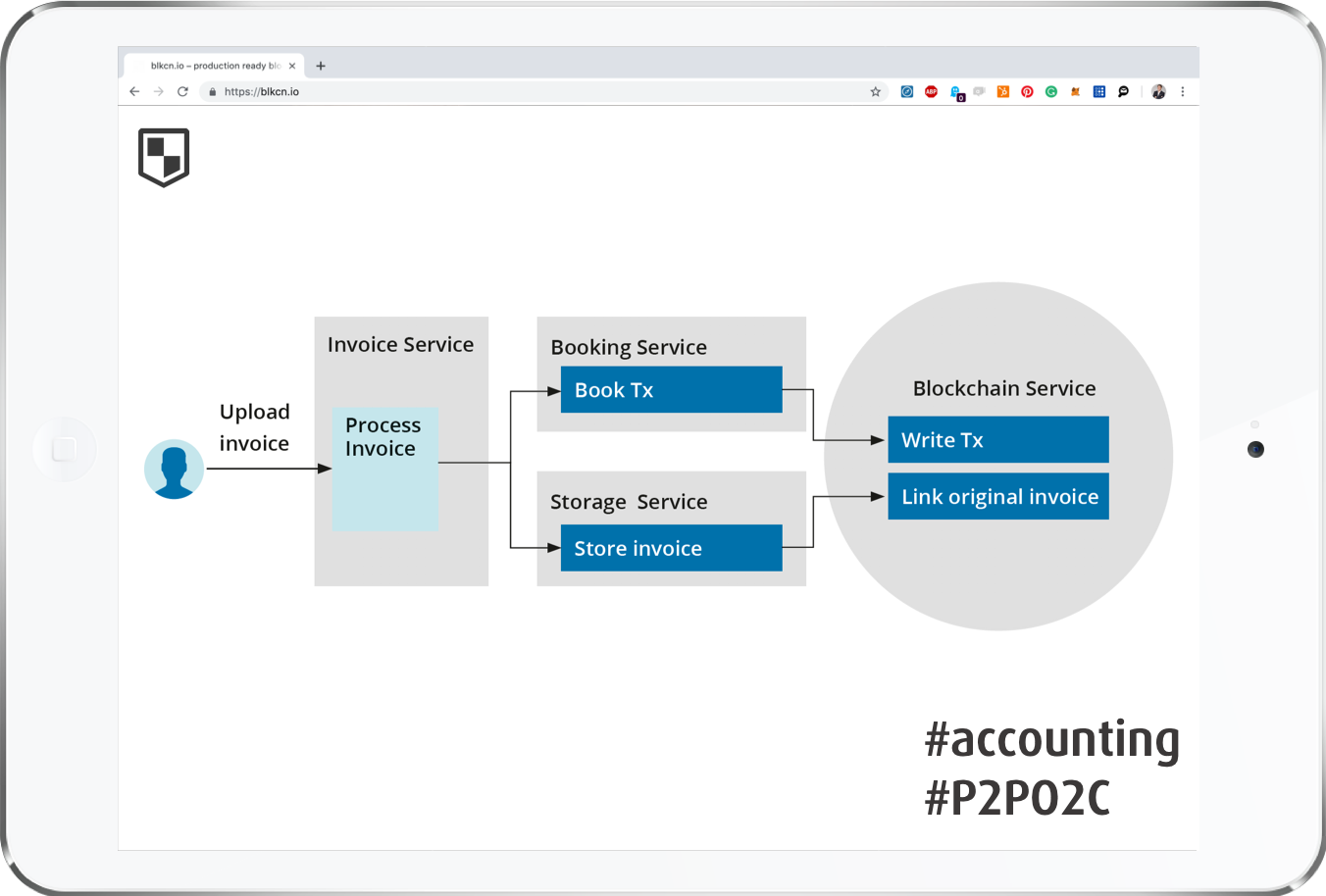

We designed a platform architecture that enables the client to automate all P2P & O2C processes in Hyperldeger Fabric. All accounting and tax services in one platform - including GDPR-compliant storage.

DETAILS

Click on the toggles to find out more about the specific project details:

The client is an SMB that offers full-service accounting and corporate finance services. Due to the highly regulated nature of its business model, several legal and regulatory restrictions had to be met with the roll-out of a DLT-based solution.

It offers a number of service lines which comprise Consulting, Legal, Payroll, Tax, Collections and Customs. The service lines were to be expanded to include financial audit services, insurance services with a digital insurance agent, and the service line Payments & Risk which covers payment processing and further services.

The goal of the project was to automate all transaction-based services on the client's accounting and tax platform. This includes services in various service lines that are performed by both in-house staff as well as external service providers.

Client Manager

The Client Manager currently plays an essential role on the platform as the single point-of-contact for all SMBs. A Client Manager is available to our customers as a central contact person, who has access to the customer’s data and documents. In this way, the Client Manager can analyze the client’s requirements optimally and transmits them to the appropriate service line, which then takes action and performs the request. If required, the client manager can also arrange for a personal conversation between the client and one of our experts of the respective service line.

The idea behind instituting the Client Manager is to enable efficiencies in time and complexity for clients as the coordination between experts is handled by the Client Manager. Instead of having to manage multiple external service providers, the client only has to send his requests to the client manager who handles the rest. The client therefore saves time and money – resources he gets to invest back into building his business and focusing on his clients.

Clients

Clients, typically SMBs, can use the platform to manage all their accounting, bookkeeping, HR management, payroll, legal, taxation, collection and customs tasks in one place. After registering for the platform and uploading essential KYC-information, they can simply upload their documents and let the platform handle the rest. Invoices, receipts, contracts and agreements are just uploaded to the platform's app and every document is accounted for according to the specified accounting rules. Clients can access services, including 3rd party services, through a single click.

Payment for services can either be done off-chain with fiat currency or on-chain using the platform’s utility token.

Moreover, clients can create new user accounts for their employees and grant permissions through rules and duties through a role-based user model.

All buying, supplying, shipping, invoicing and payment processes are handled with easy document processing by simply uploading files and letting the platform take over manual tasks while minimizing financial administration costs. The clients gain real-time visibility of their blockchain-stored data and analytics, KPI dashboards, revenue and expense reports, cash flow and EBIT including additional assessment reports and financial tables and HR management.

The client controls all of the data that is uploaded without making any trade-offs on data security (full compliance with the ISO 27001 standard). Information is shared only on a need-to-know basis addressing all privacy concerns. With smart contracts, documentation of trade and supply chain processes are streamlined and automated. The platform reduces the costs associated with manual processing of physical papers, hence fosters reduced auditing times and easier third-party controls.

3rd Parties

The platform enables buyers, sellers, carriers, auditors, banks, authorities and other third parties, such as financing, customs and service providers to easily and seamlessly transact on its platform. All financial and supply chain management aspects are covered in a single interface. Purchase-to-pay and order-to-cash processes are streamlined and manual tasks are automated to a large extent.

Artificial Intelligence inside the platform

The platform utilizes AI and algorithms that enable the following features:

- Document type and data recognition

- Check for duplicates

- Automation of workflows

- Support the user with recommendations for workflows

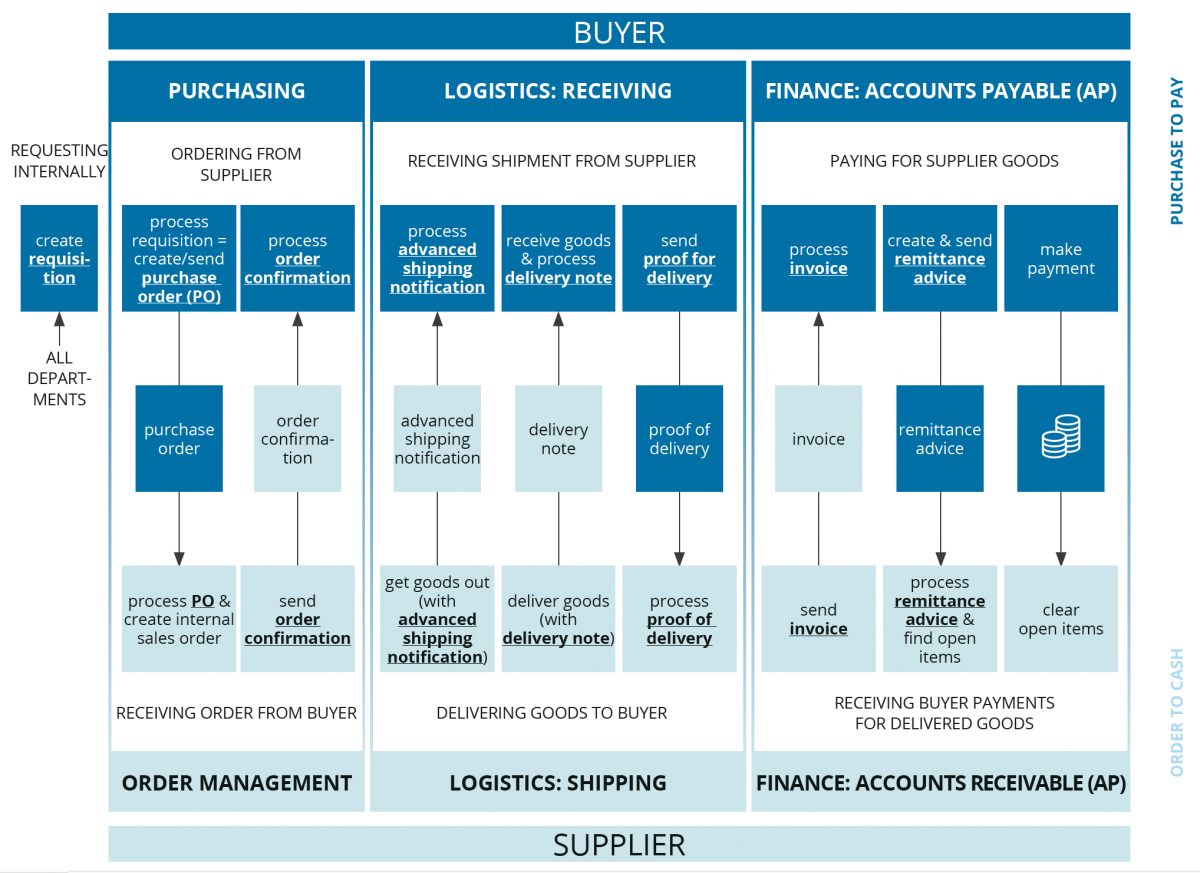

After several top-management workshops we narrowed down the core process flows that needed to be implemented in an automated fashion:

Whilst automating most of the process steps, all respective documents, purchase order, order confirmation, shipping notification etc. are automatically stored safely and securely. The data handling and document storage are fully compliant with the General Data Protection Regulation (GDPR).

Besides enabling almost automated triple-entry accounting, the DLT-based solution holds several key benefits:

- Transactional Traceability: Enabling triple entry accounting introduces a higher degree of traceability in the opaque world of accounting, meaning that every process, document, value exchange and booking is connected comprehensively to its respective counterparts.

- Transactional Immutability: Audits often rely on a high degree of credibility instead of validation of every single data point. Immutability creates this necessary degree of credibility with tamper-proof data links that are impossible to overcome.

- Document and Information Privacy: Automation of accounting processes and the support of third-party services require a data exchange that is automated, secure and private. Further, the data exchange must comply with data privacy regulation and the rightful interest of entities to share data only when necessary and only with whom has a legitimate interest.

The architecture's main components consist of three processes:

- Purchase order

- Logistics

- Payments

Here is what happens in each step.

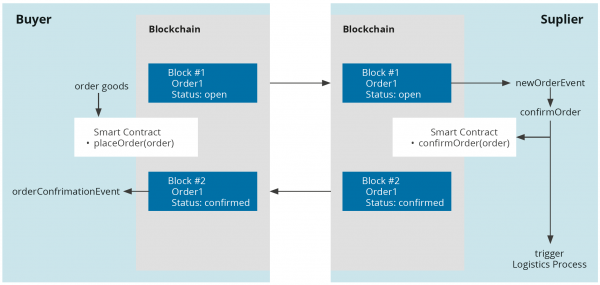

Purchase order

As the buyer realizes a requisition, he can make a purchase at his preferred supplier directly via the platform. As soon as the supplier receives the purchase order (PO) he can accept the order by sending an order confirmation and start processing. An order confirmation is cryptographically signed, hence, if the supplier accepts the PO and sends an order confirmation, he has committed himself to the fulfilment according to the terms defined. The cryptographically sealed order confirmation thus poses a legally binding obligation to deliver the ordered goods. To ensure traceability and immutability of the records the transactions are recorded on the channel’s side chain as well as committed to the main chain.

Depending on the terms and conditions both parties agreed upon, the payment process can already be triggered at this point (possibly applying a cash discount).

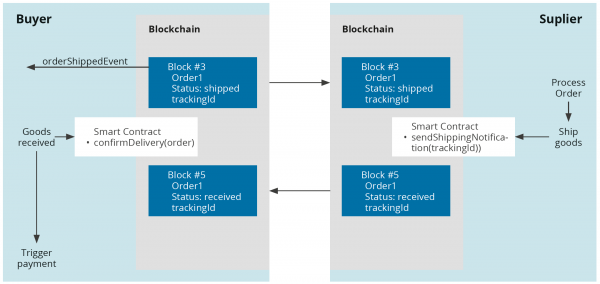

Logistics

After the supplier has finalized the ordered goods he can start the process of shipping and delivering to the buyer. Documents such as the advanced shipping notification and delivery note are sent to the user so that they can process them accordingly. As soon as the goods arrive, the buyer mark the delivery as received, which also triggers a notification of the supplier. Alternatively this information can be queried from the parcel service’s tracking service.

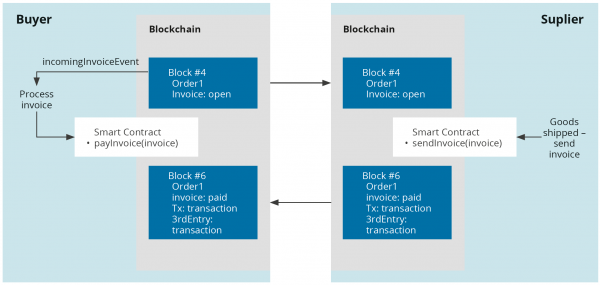

Payment

The payment process is initiated by the supplier sending the invoice to the buyer when the goods have been shipped. Automatic processing via smart contract requires information about payment and delivery status. Both are provided by special services that have access to this information. The delivery status can be easily queried from the parcel service’s tracking service, payment information are available via PSD2 interfaces, so it is possible to determine whether an invoice was paid in time or a parcel was delivered.

As soon as the buyer receives the invoice the actual payment is initiated depending on the terms of payment both parties have agreed upon. The payment will then be either performed off-chain via a remittance or an on-chain transaction paying the supplier with the platform’s utility token.

If the goods have been delivered and the delivery notification has been provided but the buyer does not pay within the agreed schedule, an automatic payment reminder is sent. This process escalates further until ultimately the process is handed over to debt collection, another service line. The details of this dunning process are completely customizable.